How to Start a Global Company

Step-by-step guide to setting up an international business with ease and legal confidence.

Read More →Expand your business in one of the most financially stable cities in Southeast Asia.

Hong Kong specializes in the finance industry, has more than 71 global banks, and a FOREX trade amounting to US$ 274.6 billion every day.

Hong Kong's superb banking regulations and infrastructure ensure your bank information and transactions remain safe and secure.

The city's traditional banks are adapting to the digital scene. Access your funds anytime, anywhere with modern online banking services.

Entrepreneurs can transfer assets and do international trade without limitations since Hong Kong has no foreign exchange restrictions.

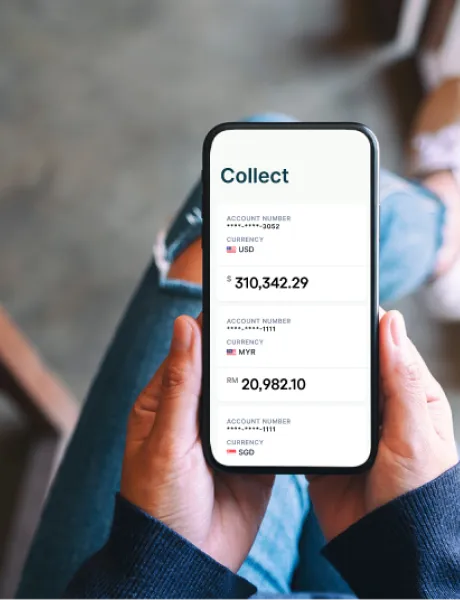

Hong Kong company bank accounts match multi-currency needs and impose no restrictions on fund transfers.

No tax on interest, low remittance fees, and lower minimum balances than other jurisdictions.

Tailored for diversity, Lion Business bridges payment gaps in sectors ranging from travel to SaaS. Our solutions resonate with your industry's specific needs, ensuring global transactional ease.

Travel

Travel

Cross-border payments and FX solutions for global travel businesses.

Online Gaming

Online Gaming

Seamless international player payouts and secure merchant settlements.

E-Commerce

E-Commerce

Accept global payments and scale your digital storefront worldwide.

FinTech

FinTech

Banking-grade solutions with compliance-ready global payment rails.

SaaS

SaaS

Recurring payments and borderless subscription billing support.

Digital Goods

Digital Goods

Grow your digital marketplace with fast, global settlement tools.

Partner with a team that combines global experience, innovation, and local insight to help your business thrive in every market.

Over 15 years of experience helping companies expand across 20+ countries.

Access a trusted network of banking, legal and corporate partners worldwide.

Personalized solutions that align with your goals and business vision.

We value long-term relationships built on transparency and trust.

Our strategies are focused on delivering measurable, sustainable success.

We guide you through every step with professional and proactive support.

Your A–Z guide to stress-free company bank account opening in Hong Kong.

Answer a few questions to estimate your success chance for opening a company bank account.

Explore our tailored solutions designed to meet your unique banking needs.

PS: This is not a sales call. We are happy to advise how you can solve the issue.

Book ConsultationWe are proud to collaborate with forward-thinking companies to build digital excellence.

Find quick answers to the most common questions about our company formation, banking, and consulting services.

Stay updated with business trends, global company setups, and financial insights from our experts.

Step-by-step guide to setting up an international business with ease and legal confidence.

Read More →

Learn how to legally minimize taxes across multiple jurisdictions.

Read More →

Explore new growth regions and untapped business opportunities around the world.

Read More →Our friendly bank account specialists are ready to help lighten your load. Partner with a team that combines experience and innovation.